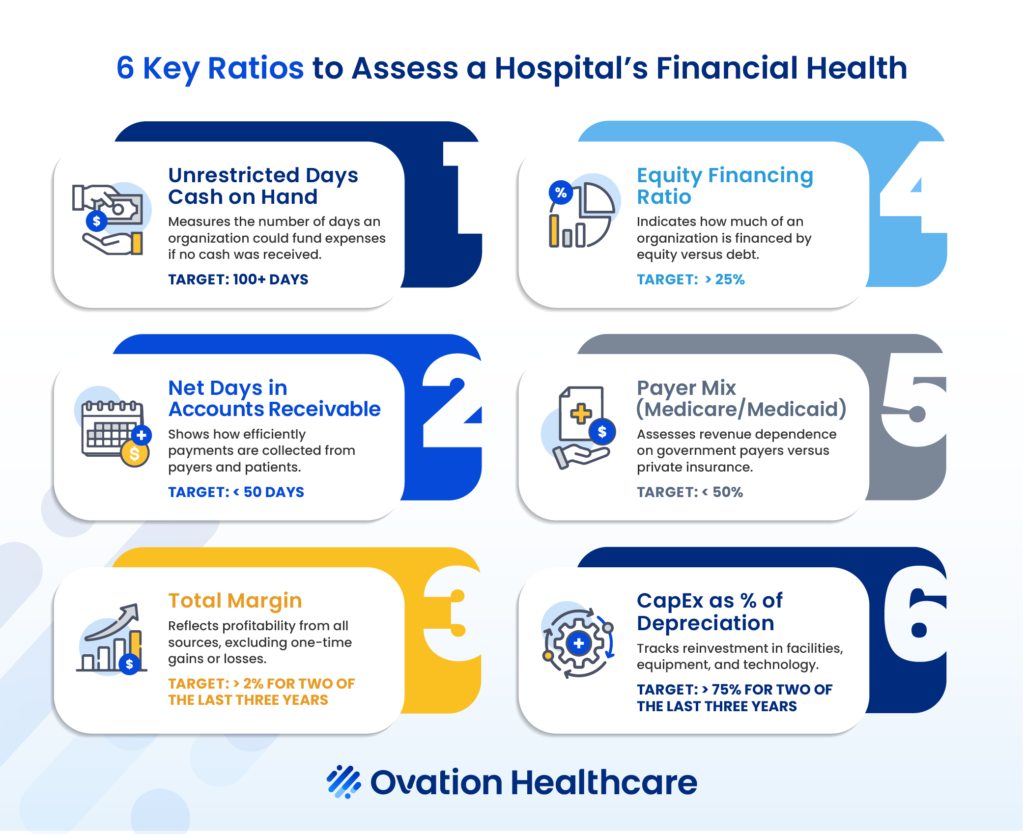

A hospital’s financial health is one of the clearest indicators of its ability to fulfill its mission and serve its community long-term. Rising labor costs, shifting payer dynamics, and capital investment needs are straining cash flows across the industry. Despite these pressures, many hospitals lack a clear, ongoing view of their financial health beyond high-level statements and budget forecasts. Understanding the metrics behind liquidity, profitability, and sustainability is crucial for boards and executives seeking to make informed decisions. These six ratios offer a concise, data-driven picture of a hospital’s financial position, helping leaders anticipate risks, prioritize resources, and chart a path toward long-term stability.

These ratios offer an at-a-glance financial pulse check that helps hospital leaders identify strengths and potential risks before they become crises. While not every board routinely tracks each measure, reviewing them regularly and comparing performance against medians can create a stronger foundation for informed decision-making.

How Ovation Healthcare Supports Financial and Operational Strength

We work alongside hospital boards and executives to interpret these key indicators and translate them into strategies that promote long-term stability.

Our collaborative approach includes:

- Comprehensive Operations and Financial Assessments to uncover the underlying issues driving underperformance and develop practical, implementable responses.

- Interim and Permanent Leadership Support to ensure capable guidance through periods of transition or transformation.

- Strategic Financial Planning to align the hospital’s goals, resources, and future growth priorities.

- Financial Reporting and Accounting Improvements that strengthen accuracy and transparency.

- Expense and Supply Chain Management to manage labor, medical, surgical, and pharmaceutical costs more effectively.

- Revenue Cycle Management and Information Technology Efficiency/Optimization to enhance payment processes, data systems, and workflows to drive better financial outcomes.

- Payer Strategy and Reimbursement Enhancement to maximize fair and timely reimbursement.

Together, these initiatives help hospitals build resilience, increase agility, and sustain financial health in an environment of constant change. Financial health is built through awareness, accountability, and consistent action. The organizations that regularly evaluate these financial indicators position themselves to withstand challenges and invest confidently in growth and innovation. By staying informed and proactive, leaders can make decisions that strengthen stability, guide strategic growth, and ensure their organization remains well-positioned for the future.